Lewis Moody Wife and Net Worth: What the MND diagnosis means for family finances and private estate planning

The recent announcement of former England rugby captain Lewis Moody’s diagnosis with Motor Neurone Disease (MND) has sent shockwaves through the sporting world and beyond. For many, it immediately brings to mind the battles fought by fellow rugby legends like Doddie Weir and Rob Burrow, who sadly succumbed to the same condition.

This devastating news not only impacts Lewis Moody personally but also carries significant implications for his wife, Annie Moody, and their family, particularly concerning their finances and long-term private estate planning. I aim to delve into these crucial aspects, offering a neutral, analytical, and informative perspective on what an MND diagnosis truly means for a family’s financial future.

Everyone at Leicester Tigers is deeply saddened to learn that one of our greatest players, Lewis Moody, has announced that he has been diagnosed with Motor Neurone Disease (MND). Our heartfelt support goes out to Lewis, his wife Annie and their family.

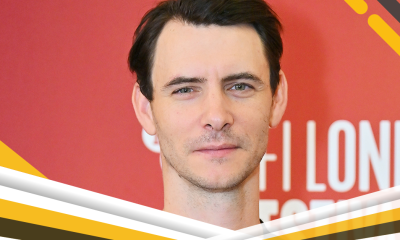

Lewis Moody: Personal Details

| Detail | Information |

|---|---|

| Full Name | Lewis Walton Moody MBE |

| Date of Birth | June 12, 1978 |

| Age | 47 (as of October 2025) |

| Wife | Annie Moody (married June 2006) |

| Children | Two sons: Dylan (17) and Ethan (15) |

| Known For | Former England rugby union player, 2003 World Cup winner, nicknamed “Mad Dog” |

| Diagnosis | Motor Neurone Disease (MND/ALS), announced October 2025 |

Lewis Moody’s MND Diagnosis: The Stark Reality

Lewis Moody revealed his MND diagnosis in October 2025, describing it as “incredibly hard to process and a huge shock” to him and his family. He noticed weakness in his shoulder during gym training, and when physiotherapy didn’t help, scans confirmed nerve damage in his brain and spinal cord due to MND.

Despite the devastating news, Moody expressed feeling “fit and well in myself” and is focused on staying positive and embracing life. His openness mirrors the courage shown by other rugby figures, raising crucial awareness about this progressive and currently incurable neurological condition.

Lewis Moody’s Wife, Annie, and the Family Unit

Annie Moody, an interior designer, married Lewis in June 2006, and they live in Bradford-on-Avon with their two teenage sons, Dylan and Ethan. She has been described as his “rock” and an integral part of their family life.

The couple co-founded The Lewis Moody Foundation in 2014, initially dedicated to funding research for brain tumours and providing memorable experiences for families affected by critical illness. With Lewis’s MND diagnosis, there’s an intention to extend the foundation’s focus to support those affected by MND.

The emotional impact on Annie and their sons, Dylan (17) and Ethan (15), has been profound. Lewis described telling his sons as “the hardest thing I’ve ever had to do,” highlighting the heartbreaking reality of facing such a diagnosis as a family. The family’s unity and resilience are evident, as they navigate this new challenge together, with Annie Moody playing a pivotal supportive role.

Understanding Lewis Moody’s Net Worth

Lewis Moody’s career as a celebrated rugby player, including winning the 2003 World Cup and captaining England, undoubtedly contributed significantly to his financial standing. Estimates for his net worth in 2025 vary, with some placing it around $5 million (approximately £4 million) and others suggesting up to $25 million.

These figures are largely attributed to his rugby earnings, which reportedly reached £250,000–£350,000 per season at his peak, along with brand endorsements and international match fees.

Beyond his playing career, Moody has engaged in various ventures, including public speaking engagements, performance coaching, and his charitable foundation. These activities have helped build a lasting financial legacy, although the exact breakdown of his current assets and liabilities remains private.

MND and Family Finances: A Comprehensive Look

An MND diagnosis can introduce substantial and often overwhelming financial burdens for families. Research indicates that households affected by MND typically incur significant additional costs.

- Healthcare and Care Costs: The progressive nature of MND means increasing needs for specialised medical care, equipment, and personal assistance. These can include wheelchairs, communication aids, home adaptations, and professional care services. On average, people with MND and their families can spend an additional £9,645 per year in regular and enhanced costs, plus around £2,175 in one-off costs. Some families report spending an average of £14,500 a year on direct costs.

- Loss of Income Potential: The illness often leads to individuals being unable to work, resulting in a permanent loss of income. Moreover, family members, particularly spouses, may have to reduce their working hours or leave employment entirely to provide unpaid care, further impacting household income.

- Home Adaptations and Accessibility: As mobility declines, homes often require significant modifications to ensure accessibility and safety, such as ramps, stairlifts, and adapted bathrooms, which can be very costly.

- Increased Utility Costs: The reliance on electrically powered assistive equipment can lead to substantially higher energy bills. Some families report spending an astronomical £10,000 a year on electricity for their equipment.

- Insurance and Pensions: Issues with insurance and pensions can arise, adding to the financial strain. Over two-thirds of families use their savings to cope with these extra costs.

The financial impact is often compounded by the emotional toll, leading to worry, anxiety, and despair among affected families.

Private Estate Planning: Safeguarding the Future

Given the progressive and terminal nature of MND, proactive and thorough private estate planning becomes critically important. This process helps ensure that a person’s wishes are respected and that their family is financially secure and supported.

- Importance of Early Planning: Engaging with an estate planning attorney as soon as possible after diagnosis is crucial. This ensures that documents can be created while the individual still has the legal capacity to make such decisions, avoiding potential future complications and court interventions.

- Wills and Trusts: A comprehensive will dictates how assets will be distributed, ensuring loved ones are provided for according to personal wishes. Without a will, the law determines the distribution, which may not align with the individual’s desires. Trusts can also be established to manage assets for the benefit of family members, potentially offering greater control and tax efficiency.

- Lasting Power of Attorney (LPA): This legal document allows an individual to appoint someone to make decisions on their behalf if they lose mental capacity. There are two main types: one for financial and property affairs, and another for health and welfare decisions. Registering an LPA is a vital step to ensure that a trusted person can manage finances and healthcare choices when the individual is no longer able to.

- Insurance Review: Reviewing existing life insurance, critical illness cover, and income protection policies is essential. While a diagnosis like MND might limit new policy options, existing policies should be thoroughly checked for their terms and payouts.

- Financial Inventories and Access: Consolidating all important financial documents, accounts, and legal records in a secure, accessible location, and ensuring trusted individuals (like an executor or Power of Attorney) know where to find them, simplifies future administration.

- Tax Implications: Seeking advice on inheritance tax planning is prudent, especially given the potential value of Lewis Moody’s estate. Gifts made within certain timeframes before death may be subject to inheritance tax.

The Broader Impact: Awareness and Support

Lewis Moody’s decision to share his diagnosis publicly amplifies the urgent need for greater awareness and research funding for MND. His former clubs, including Leicester Tigers, and the wider rugby community have rallied with messages of support, and a GoFundMe page has been set up by former teammates to support him and his family.

This collective action underscores the powerful role of public figures in highlighting critical health issues and mobilising support for affected individuals and their families.

Conclusion

The news of Lewis Moody’s MND diagnosis is a sobering reminder of life’s unpredictability and the profound challenges that can arise. While the emotional toll on Lewis, Annie Moody, and their sons is immeasurable, the financial implications necessitate careful consideration and proactive planning.

Understanding the potential costs associated with MND care and taking timely steps in private estate planning—from updating wills and establishing Lasting Powers of Attorney to reviewing insurance and consolidating financial information—are crucial for safeguarding the family’s future. As Lewis Moody continues to embrace life with the unwavering support of his wife and family, his journey serves as a powerful call to action for comprehensive financial preparedness in the face of such a formidable diagnosis.