Crypto Market: 72 Top Coins Still Down Over 50%

A recent report by Galaxy Research has cast a spotlight on the current state of the cryptocurrency market, revealing that a significant majority of the top digital assets are still trading far below their all-time peak prices. The research indicates that 72 out of the top 100 cryptocurrencies by market capitalization are currently more than 50% down from their record highs, illustrating a divergent recovery path within the broader crypto ecosystem.

Mid-Cap Altcoins Bear the Brunt of Declines

The findings from Galaxy Research highlight a particularly challenging environment for many mid- and lower-cap altcoins. Cryptocurrencies such as Filecoin (FIL), The Graph (GRT), Tezos (XTZ), and Polkadot (DOT) are noted to be languishing between 80% and 95% below their previous record valuations. This substantial decline suggests that many projects launched during the exuberant 2021 bull cycle, often with high Fully Diluted Valuations (FDV), have struggled to deliver on the initial hype and expectations, leading to prolonged downturns for their token prices.

Large-Cap Cryptos Show Resilience Amidst Broader Market Weakness

In contrast to the widespread declines observed in many altcoins, a select group of large-cap assets has demonstrated relative strength. Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), and LEO Token are cited as examples of cryptocurrencies that are currently within 30% or less of their previous all-time highs. This suggests a more robust performance for the established leaders of the crypto market.

XRP also stands out, positioned approximately 40% below its all-time high and being among the few cryptocurrencies that have recorded substantial gains year-to-date, surging over 327%. While a recent liquidation event contributed to over 50% of the total losses for large-cap assets, the broader market context includes increasing institutional participation through avenues like ETFs and a more crypto-friendly political discourse, exemplified by certain administrative policies. Despite these positive developments, the research underscores that most crypto assets have yet to reclaim even half of their lost value from peak levels.

The Shifting Landscape of the Crypto Market and the “K-Shaped Recovery”

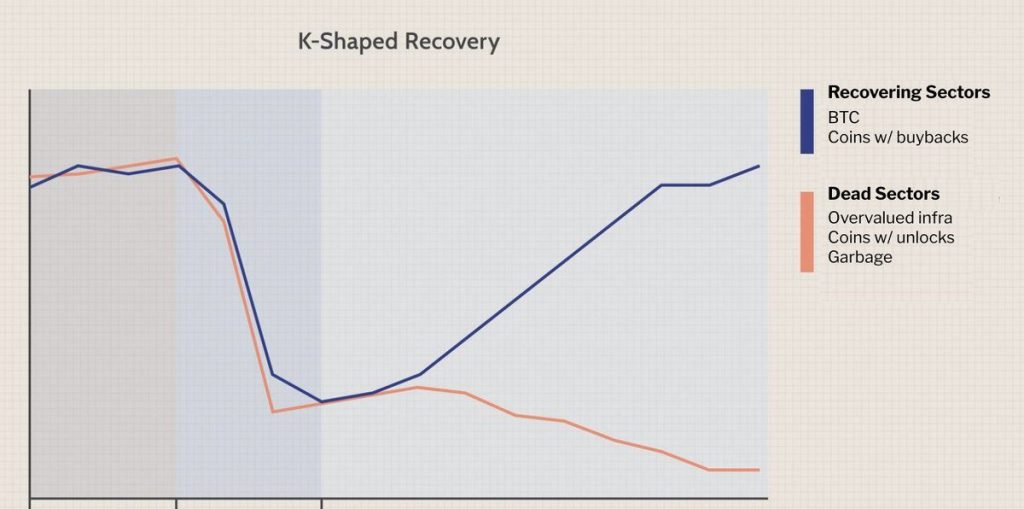

The current market dynamics suggest a selective recovery, often termed a “K-shaped recovery,” according to insights shared by Taiki Maeda, founder of HFA Research. This model posits that only top-tier cryptocurrencies, particularly those with strong fundamentals, active buyback mechanisms, and sustainable recurring revenue generation models, are likely to thrive and reach new highs. Conversely, other sectors within the crypto space are projected to continue struggling or even face obsolescence.

Maeda’s analysis identifies “dead crypto sectors” as those encompassing certain gaming tokens, AI agents, memecoins built on overvalued infrastructure, and projects burdened by large token unlock schedules that can lead to significant supply dilution. This perspective suggests that cautious investors may increasingly favor established assets like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Binance Coin (BNB), and other projects demonstrating verifiable utility and economic models.

Massive Number of Crypto Tokens Have Failed Since 2021

Adding another layer to the narrative of market consolidation and divergence is research from CoinGecko, which reveals a staggering number of failed crypto projects. Over 50% of all cryptocurrencies launched have ceased trading, with approximately 3.7 million crypto tokens or projects deemed to have failed since 2021. The first quarter of 2025 alone witnessed the collapse of 1.8 million tokens, accounting for nearly half of all recorded project failures.

A significant portion of these defunct tokens is linked to the emergence of platforms like `pump.fun`, which simplified the token creation process, leading to a proliferation of meme coins and projects with minimal development effort. This influx of low-quality assets has, according to some analysts, diluted market liquidity and contributed to the absence of a broad “altseason” in the current cycle, where most altcoins would experience explosive rallies simultaneously.

Industry Perspectives: Peter Thiel’s Cautious Outlook on Bitcoin

The cautious sentiment extends even to established blue-chip cryptocurrencies, with prominent tech investor Peter Thiel expressing reservations about Bitcoin’s potential for significant future upside. Thiel suggests that Bitcoin’s increasing integration with institutions, such as BlackRock, and government interest may have shifted its trajectory, making it less retail-driven and potentially limiting its dramatic growth prospects.

When questioned about his Bitcoin holdings, Thiel stated, “Have I sold any of my Bitcoin? I still hold some. I didn’t buy as much as I should have. I’m not sure it’s going to go up that dramatically from here. We got the ETF addition, and I don’t know who else buys it quickly from here.” While he maintains a small position and believes some upside is possible, he anticipates a volatile and challenging path forward.

Conclusion: A Maturing Yet Volatile Crypto Market

The analysis from Galaxy Research, coupled with broader market observations and expert opinions, paints a picture of a cryptocurrency market undergoing a significant transformation. While a handful of large-cap assets demonstrate resilience, the vast majority of cryptocurrencies, particularly mid and lower-cap altcoins, are struggling to recover from substantial drawdowns. The notion of a “K-shaped recovery” suggests a future where fundamental strength and sustainable models will be critical differentiators, as the market grapples with a flood of failed projects and evolving institutional participation. Investors are increasingly navigating a landscape where selectivity, rather than broad market participation, appears to be the prudent approach.